8

Million

Farmers

28

States across

India

100

Agri Commodity Value chains

6,500+

Farmer

Collectives

Million

Farmers

States across

India

Agri Commodity Value chains

Farmer

Collectives

About

Samunnati Finance

Private Limited

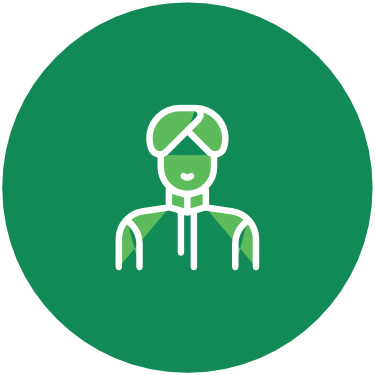

Samunnati Finance Private Limited, a Non Banking Financial Company (NBFC), advances sustainable finance in agriculture. We provide customised financial solutions to farmer collectives, agri-enterprises, and rural

communities, bridging gaps in financial access.

Headquartered in Chennai, we operate

nationwide, fostering financial inclusion, climate smart agriculture, renewable energy, and sustainable value chains. Partnering with Farmer Producer Organisations and agri-businesses, we support working capital, asset creation, water conservation, and agri-tech adoption. We empower farmers, driving productivity, economic growth,

and a sustainable, inclusive agricultural ecosystem.

Vision

Make markets work for the

smallholder farmers and make

agri value chains operate at a

higher equilibrium.

Mission

To provide smallholder farmers and agri enterprises access to markets through financial intermediation, market linkages, and advisory services so that the enterprises and value chains that they are engaged in, operate at a higher equilibrium thereby creating value for all stakeholders in the agri value chain.

Mission

To provide smallholder farmers and agri enterprises access to markets through financial intermediation, market linkages, and advisory services so that the enterprises and value chains that they are engaged in, operate at a higher equilibrium thereby creating value for all stakeholders in the agri value chain.

Customized Loan Solutions

Flexible financing options to help you grow and thrive

Working Capital

Solutions

We offer tailored financial solutions to address working capital challenges across the agricultural value chain. Our innovative financing options empower agri-traders, manufacturers, dealers, and distributors to unlock growth opportunities and enhance operational efficiency.

Receivable

Financing Solutions

A short-term financing solution for agri traders and manufacturers to receive payments against unpaid sales invoices due in the future.

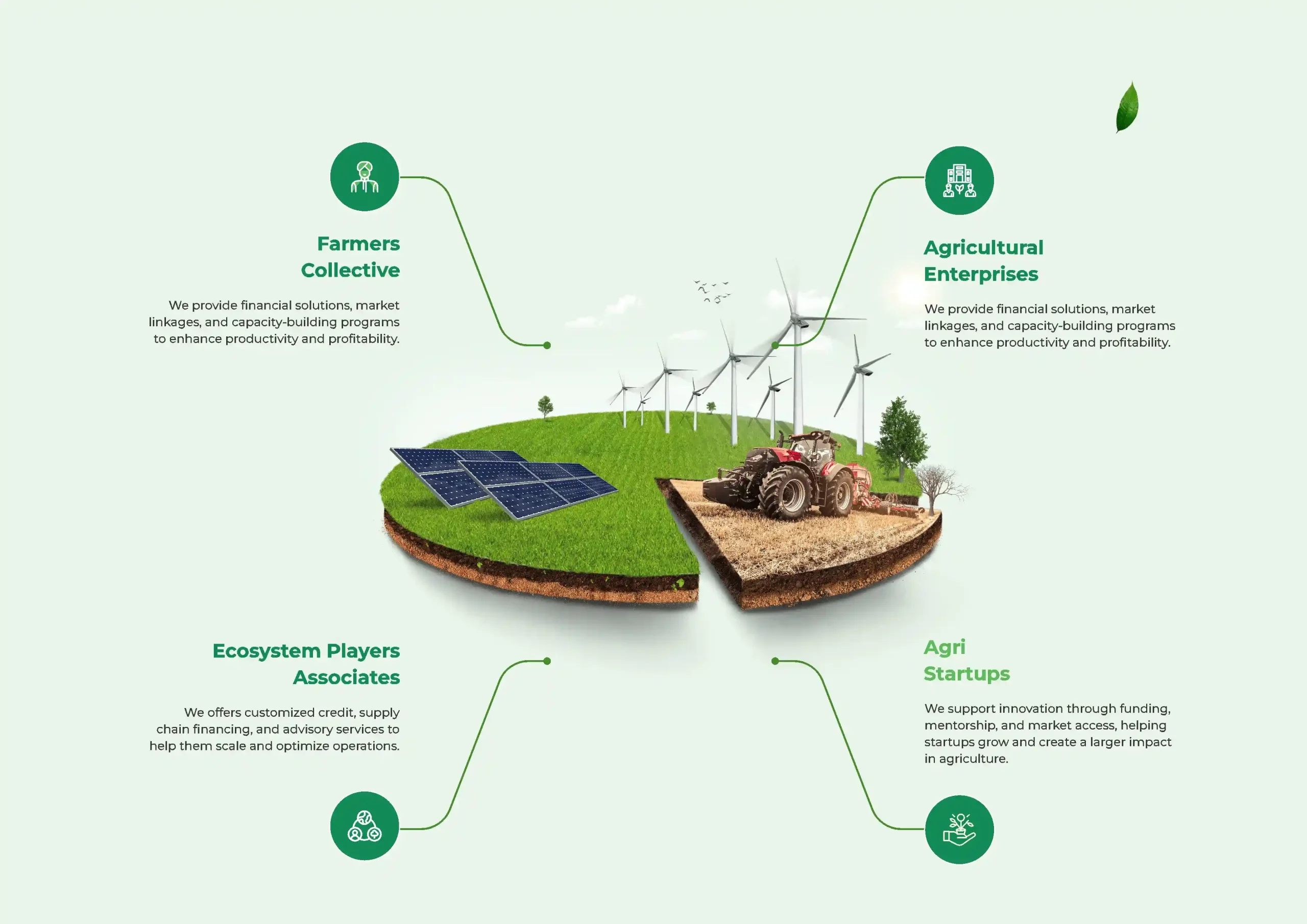

Farmers

Collective

We provide financial solutions, market linkages, and capacity-building programs to enhance productivity and profitability

Agricultural

Enterprises

We offers customized credit, supply chain financing, and advisory services to help them scale and optimize operations.

Ecosystem Players

Associates

We offers customized credit, supply chain financing, and advisory services to help them scale and optimize operations

Agri

Startups

We support innovation through funding, mentorship, and market access, helping startups grow and create a larger impact in agriculture.

Farmers

Collective

We provide financial solutions, market linkages, and capacity-building programs to enhance productivity and profitability

Agricultural

Enterprises

We offers customized credit, supply chain financing, and advisory services to help them scale and optimize operations.

Ecosystem Players

Associates

We facilitate collaboration, knowledgesharing, and financial partnerships to strengthen the agricultural ecosystem.

Agri

Startups

We support innovation through funding, mentorship, and market access, helping startups grow and create a larger impact in agriculture.

Explore our latest blogs

On financial inclusion, market linkages, and AgriTech innovations, empowering

farmers and agribusinesses across India

From Exclusion to Empowerment: The Role of FPOs in Financial Inclusion

Working Capital Challenges in Agribusiness and How to Overcome Them

Working Capital Challenges in Agribusiness and How to Overcome Them

Working Capital Challenges in Agribusiness and How to Overcome Them

Working Capital Challenges in Agribusiness and How to Overcome Them

Frequently Asked Questions

Everything You Need to Know

Everything You Need to Know

Samunnati Finance Private Limited connects FPOs and agribusinesses with institutional buyers, financial resources, and advisory support to improve efficiency, scale operations, and access better market opportunities.

Samunnati Finance Private Limited supports the transition to sustainable agricultural practices by promoting renewable energy solutions that enhance productivity while reducing environmental impact.

Samunnati Finance Private Limited financial solutions cater to:

Farmer Collectives

Agricultural Enterprises

Ecosystem Players

Associates

Agri Startups

You can reach out to Samunnati Finance Private Limited through the Contact Us section on the website for financial assistance, partnerships, and general inquiries.

Driving Growth and Transformation:

Samunnati's Commitment to Empowering Smallholder Farmers

Our financial solutions drive sustainable development and through these solutions, we help reduce poverty by improving rural livelihoods, enhance food security through better access to finance, and promote gender equality by supporting women-led initiatives. Our funding for solar-powered technology solutions and climate-smart agriculture fosters environmental sustainability, while our overall working credit solutions strengthen value chains, creating jobs and boosting economic growth. By enabling responsible consumption and production and building resilience against climate change, we are transforming India's agri-sector for a more inclusive and sustainable future.

Partners

Joining Hands For A

Shared Vision